Aimbridge Connection

Connecting You to the Latest in Hospitality and Travel Insights.

Why Your Business Needs a Safety Net, Not Just a Dream

Discover why a safety net is essential for your business success. Don't just dream—learn to build a secure future today!

The Importance of a Safety Net for Business Success

In today's unpredictable business landscape, having a strong safety net is crucial for long-term success. A safety net can take various forms, such as an emergency fund, diversified income streams, or comprehensive insurance policies. These elements not only provide financial stability but also foster confidence in decision-making. When businesses prepare for unexpected challenges, they diminish the risks associated with economic downturns or sudden market changes, ensuring they can continue to operate effectively.

Moreover, a well-defined safety net can enhance a company's reputation and trust among stakeholders. Customers and investors are more likely to engage with businesses that demonstrate resilience and preparedness. By proactively managing risks, companies can sustain their growth trajectory and focus on innovation rather than merely surviving economic turbulence. Ultimately, a robust safety net not only protects a business but also positions it for future opportunities, making it an essential strategy for enduring success.

How to Build a Safety Net: Strategies for Entrepreneurs

Building a safety net is crucial for entrepreneurs as it provides both financial and emotional security in the face of uncertainty. One effective strategy is to establish an emergency fund, aiming for at least three to six months’ worth of living expenses. This fund can help absorb unexpected costs such as market fluctuations or personal emergencies, ensuring that you can focus on your business without distraction. Additionally, consider diversifying your income streams; this could include freelance work, consulting, or even investing in passive income opportunities. By not putting all your eggs in one basket, you create a buffer that helps stabilize your financial situation.

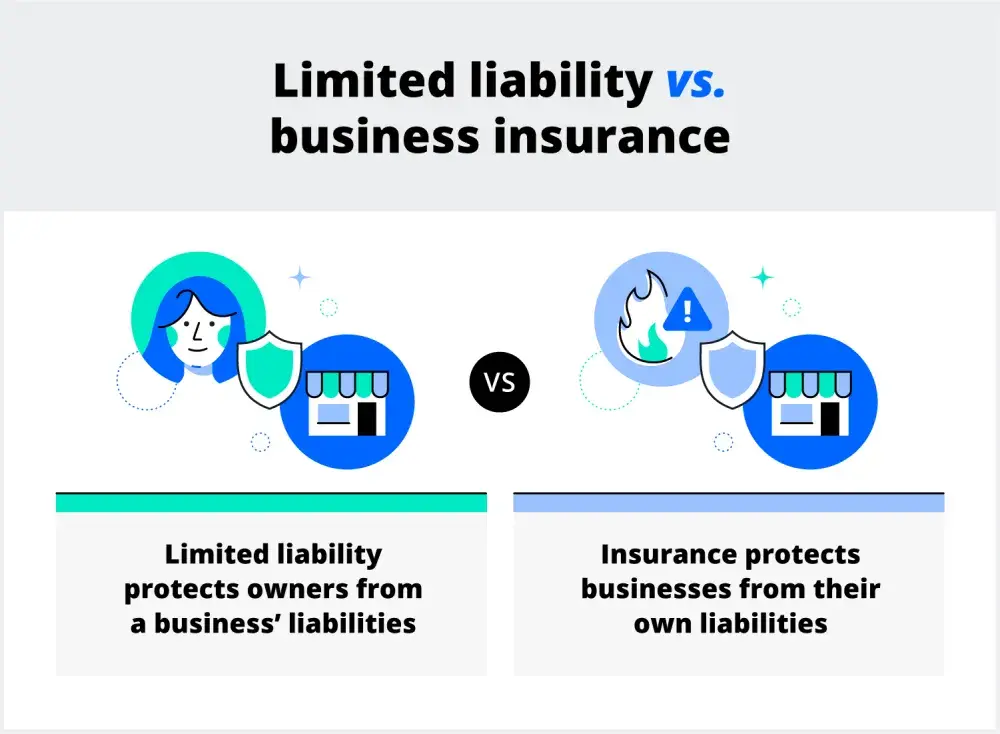

Another important aspect of creating a safety net is investing in insurance. Various types of business insurance can protect against potential risks, such as liability, property damage, and even business interruption. Furthermore, it’s vital to develop a strong network of mentors and advisors who can provide valuable insights and guidance during challenging times. Regularly revisiting and adjusting your business plan can also bolster your safety net; staying proactive in identifying potential challenges and opportunities will help you navigate the entrepreneurial landscape with greater confidence.

Is Your Business Prepared for the Unexpected?

In today’s fast-paced business environment, the question Is Your Business Prepared for the Unexpected? has become more critical than ever. Natural disasters, sudden market shifts, or unexpected operational challenges can occur at any moment, potentially jeopardizing your company's stability. To effectively navigate these unforeseen circumstances, businesses must have a robust risk management plan in place. This plan should outline key strategies such as conducting regular risk assessments, implementing operational contingencies, and training staff to respond promptly to emergencies.

Preparation involves more than just having a plan; it requires a commitment to continuous improvement. Establishing a culture of resilience can significantly enhance your business's ability to adapt and recover. Consider incorporating regular simulation exercises to test your response strategies and involve your entire team in the process. Remember, the goal is not just to survive unexpected challenges but to emerge from them stronger. By asking yourself Is Your Business Prepared for the Unexpected?, you take the first step towards fostering a proactive mindset that prioritizes long-term success.