Aimbridge Connection

Connecting You to the Latest in Hospitality and Travel Insights.

Insurance Undercover: What Every Small Business Needs to Know

Unlock the secrets of insurance! Discover vital tips every small business must know to protect your assets and thrive.

Top 5 Insurance Myths Every Small Business Owner Should Know

As a small business owner, navigating the world of insurance can be daunting, especially with the prevalence of misconceptions that can lead to costly mistakes. One of the most common myths is that small businesses don’t need insurance. In reality, every business, regardless of size, faces risks that could jeopardize its financial stability. While some may think that being a small operation minimizes risk, liabilities like employee injuries, property damage, or lawsuits can arise unexpectedly. For more information on the importance of insurance for small businesses, check out this article from the SBA.

Another prevalent myth is that workers' compensation insurance isn't necessary for part-time employees. In fact, many states require coverage for part-time workers, just as they do for full-time employees. Failing to secure the appropriate insurance can result in hefty fines and legal troubles. Understanding your state's regulations is crucial for compliance and safeguarding your business. For detailed insights on workers' compensation laws, visit Nolo's FAQ on Workers' Compensation.

Essential Insurance Coverage: What Your Small Business Needs to Thrive

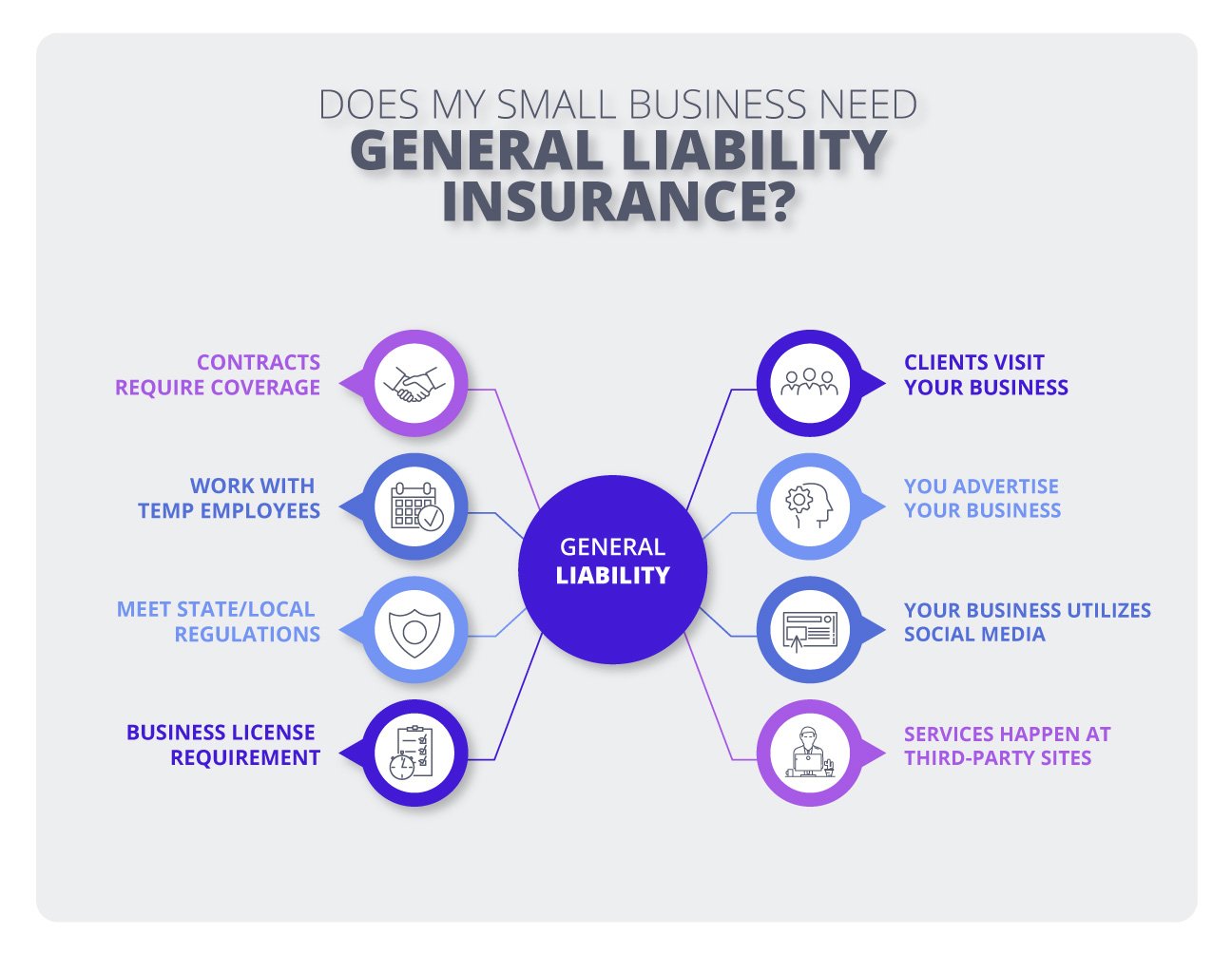

When running a small business, ensuring you have essential insurance coverage is a critical component for success and sustainability. Every business faces unique risks, but some common types of insurance should be considered universally. These include general liability insurance, which protects against claims of bodily injury or property damage, and professional liability insurance, which guards against claims of negligence or poor performance. Additionally, business interruption insurance can provide crucial support in case your operations are halted unexpectedly, ensuring that you can continue meeting your financial obligations.

Another key aspect of essential insurance coverage is workers' compensation insurance, which is typically required if you have employees. This insurance covers medical costs and lost wages for employees injured on the job, thus fostering a safer work environment. Lastly, consider property insurance to protect your business assets from risks such as fire, theft, or natural disasters. By investing in these insurance types, you create a safety net that allows your business to thrive even in the face of unforeseen challenges.

How to Choose the Right Insurance Policy for Your Small Business

Choosing the right insurance policy for your small business involves careful consideration of various factors. Start by conducting a thorough risk assessment to identify potential vulnerabilities your business may face. Common types of insurance policies to consider include general liability insurance, property insurance, and workers' compensation insurance. Each of these covers different aspects of your business risks. For a detailed overview, visit the SBA's insurance guide.

Once you have identified your coverage needs, it's crucial to compare options from multiple providers. Look for policies that not only offer competitive rates but also provide adequate coverage specific to your industry. Reading customer reviews and checking ratings from J.D. Power can help you assess the reliability of different insurers. Additionally, consider consulting with an insurance broker who specializes in small business insurance to make an informed decision.