Aimbridge Connection

Connecting You to the Latest in Hospitality and Travel Insights.

Crypto Market Volatility: The Rollercoaster You Didn't Sign Up For

Explore the wild world of crypto market volatility! Discover the secrets behind the rollercoaster ride and how to navigate it like a pro.

Understanding Crypto Market Volatility: What Causes the Wild Swings?

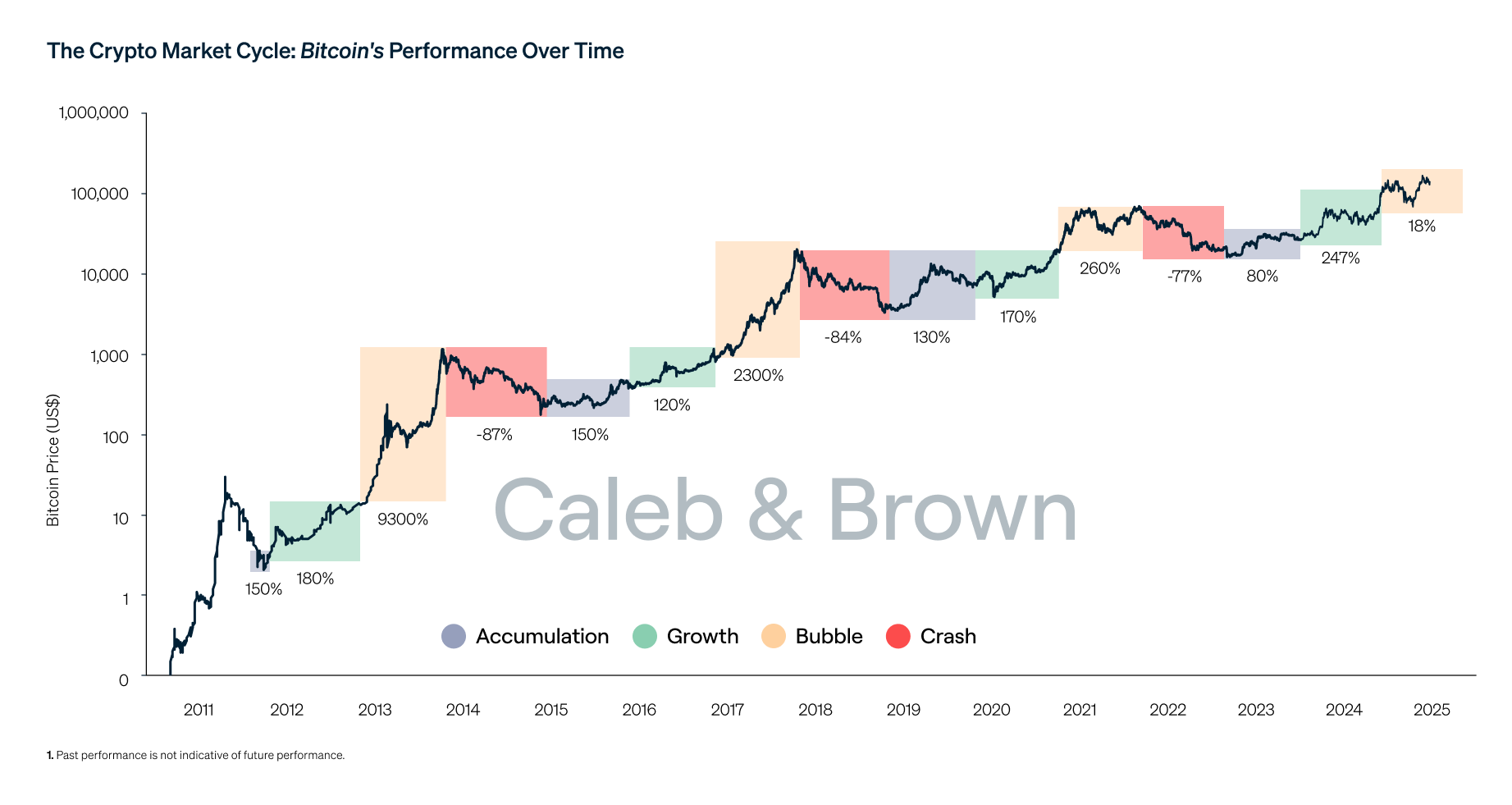

Understanding crypto market volatility is crucial for investors navigating the frequently turbulent waters of digital assets. One primary factor contributing to these wild swings is the speculative nature of the market. Unlike traditional financial markets, cryptocurrencies are often driven by market sentiments, news events, and social media trends, leading to rapid price changes. Additionally, the relatively small market capitalization of many cryptocurrencies compared to traditional assets amplifies price movements, as limited buy or sell orders can significantly impact overall market prices.

Another factor influencing cryptocurrency volatility is regulatory developments. Announcements regarding government regulations or legal issues can send shockwaves through the market, prompting quick reactions from traders. Moreover, the technological factors that underpin cryptocurrencies can lead to fluctuations; for example, network upgrades or security breaches can cause sudden drops in value. Ultimately, understanding these components of crypto market volatility is essential for anyone looking to invest wisely in this dynamic marketplace.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, where teams of terrorists and counter-terrorists battle to complete objectives. For players looking to enhance their gaming experience, using a cloudbet promo code can provide exciting bonuses and rewards.

Tips for Navigating the Crypto Rollercoaster: Strategies for Investors

Navigating the crypto rollercoaster can be daunting, especially for new investors. The first strategy is to conduct thorough research before diving into any cryptocurrency. Familiarizing yourself with market trends, technology behind different coins, and current news can significantly influence your investment decisions. Additionally, consider establishing a diversified portfolio to mitigate risks. This means investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as smaller altcoins that may present growth opportunities.

Another essential tip is to develop a clear investment strategy, tailored to your financial goals and risk tolerance. Set specific targets for buying and selling, and adhere to them to avoid emotional trading. Utilizing tools like stop-loss orders can help protect your investments from extreme price fluctuations. Finally, stay informed about regulatory changes and global events that can impact the crypto market, as these factors can contribute to the unpredictable nature of the crypto rollercoaster.

Is Crypto Volatility Here to Stay? Analyzing Market Trends and Future Predictions

The world of cryptocurrency has been characterized by its volatility, with prices swinging dramatically from highs to lows in short periods. As we analyze the current market trends, it's clear that factors such as regulatory developments, technological advancements, and investor sentiment play crucial roles in driving these fluctuations. A recent study by industry experts indicates that crypto volatility is likely to persist, influenced by increasing adoption and speculation surrounding digital assets. Investors should be prepared for both opportunities and risks that this unpredictable nature brings.

Looking ahead, predictions suggest that as more institutional players enter the market, the overall volatility may experience a shift. However, this does not imply a complete stabilization; rather, the potential for crypto volatility could remain, albeit with differing intensity. Many analysts believe that the maturation of the market, along with improved infrastructure and regulation, could lead to a more predictable environment. Nevertheless, it’s essential for investors to stay updated on trends and remain cautious, as the unique characteristics of the crypto market continue to present both challenges and rewards.