Aimbridge Connection

Connecting You to the Latest in Hospitality and Travel Insights.

When Skin Trading Ecosystems Go Up in Smoke

Uncover the shocking truth behind skin trading ecosystems and why they might be on the brink of collapse. Don't miss out on this eye-opening read!

Understanding the Risks: What Happens When Skin Trading Ecosystems Collapse?

As skin trading ecosystems gain popularity within the gaming community, understanding the risks associated with their potential collapse becomes crucial. These ecosystems rely heavily on virtual currency and rare in-game items, making them susceptible to market fluctuations and regulatory scrutiny. When such a system collapses, users may face significant financial losses, as their invested time and resources can vanish overnight. Moreover, the lure of easy profits can encourage risky behaviors, such as gambling, leading players to invest more than they can afford.

In the event of a collapse, the repercussions extend beyond individual losses. The entire gaming environment can suffer, as trust diminishes among players and developers alike. Additionally, communities built around these trading platforms may disintegrate, leaving many players feeling isolated and disillusioned. Therefore, it is imperative for stakeholders to remain vigilant and foster a transparent, sustainable trading ecosystem to mitigate these risks and enhance player confidence.

Counter-Strike has long been a staple in the competitive gaming community, with its intense team-based gameplay and tactical depth. Every iteration of the game, including the latest update in CS2, has faced challenges, including a significant market cap crash cs2 that caught many players off guard. The game's strategic nuances and continuous updates keep players engaged, making it a timeless classic in the realm of esports.

The Dark Side of Skin Trading: Why Valuations Can Disappear Overnight

The world of skin trading can often appear glamorous, yet it harbors numerous risks that can lead to devastating losses. Investment valuations in this niche market can plummet overnight due to various factors, such as shifting regulations, market saturation, and evolving consumer preferences. For instance, when new laws emerge that tighten the grip on the trading of skin products, it can render established businesses untenable. This volatility underscores the precarious nature of skin trading; one day, a product might be the next big thing, and the next, it could become virtually worthless.

Moreover, the psychological impact on investors cannot be overlooked. Many enter the skin trading sphere driven by emotions, swayed by marketing hype or trends, rather than grounded research. Valuations can vanish in an instant as market dynamics shift. It's crucial for investors to adopt a well-informed approach and recognize the potential for rapid declines in asset worth, reminding them that the market can be as unforgiving as it is lucrative. Understanding the risks associated with skin trading is paramount in ensuring one navigates this uncharted territory with caution.

Are You Still Trading Safely? Signs Your Skin Trading Ecosystem is in Trouble

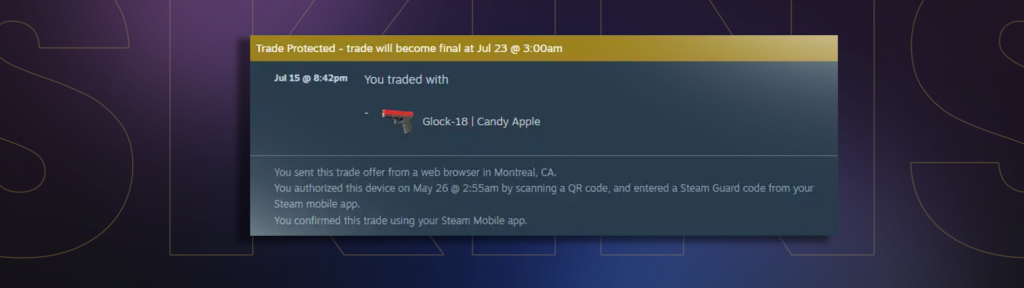

In today's fast-paced digital marketplace, it's crucial to evaluate whether you are trading safely. One of the first signs that your skin trading ecosystem might be in trouble is a decrease in the performance of your transactions. If you notice a sudden surge in returns, refund requests, or negative feedback, it may indicate that your customer base is becoming dissatisfied. Monitoring these metrics consistently can help you identify potential issues before they escalate.

Another significant indicator is the decline in community engagement around your trading platform. If your loyal followers are becoming less active or are voicing concerns about the quality of transactions, it's time to reassess your practices. Establishing a feedback loop can be essential; consider implementing surveys or social media polls to gauge user satisfaction and concerns. Remember, staying connected and responsive to your community is key to maintaining a safe trading environment.